Why Invest in Mutual Funds?

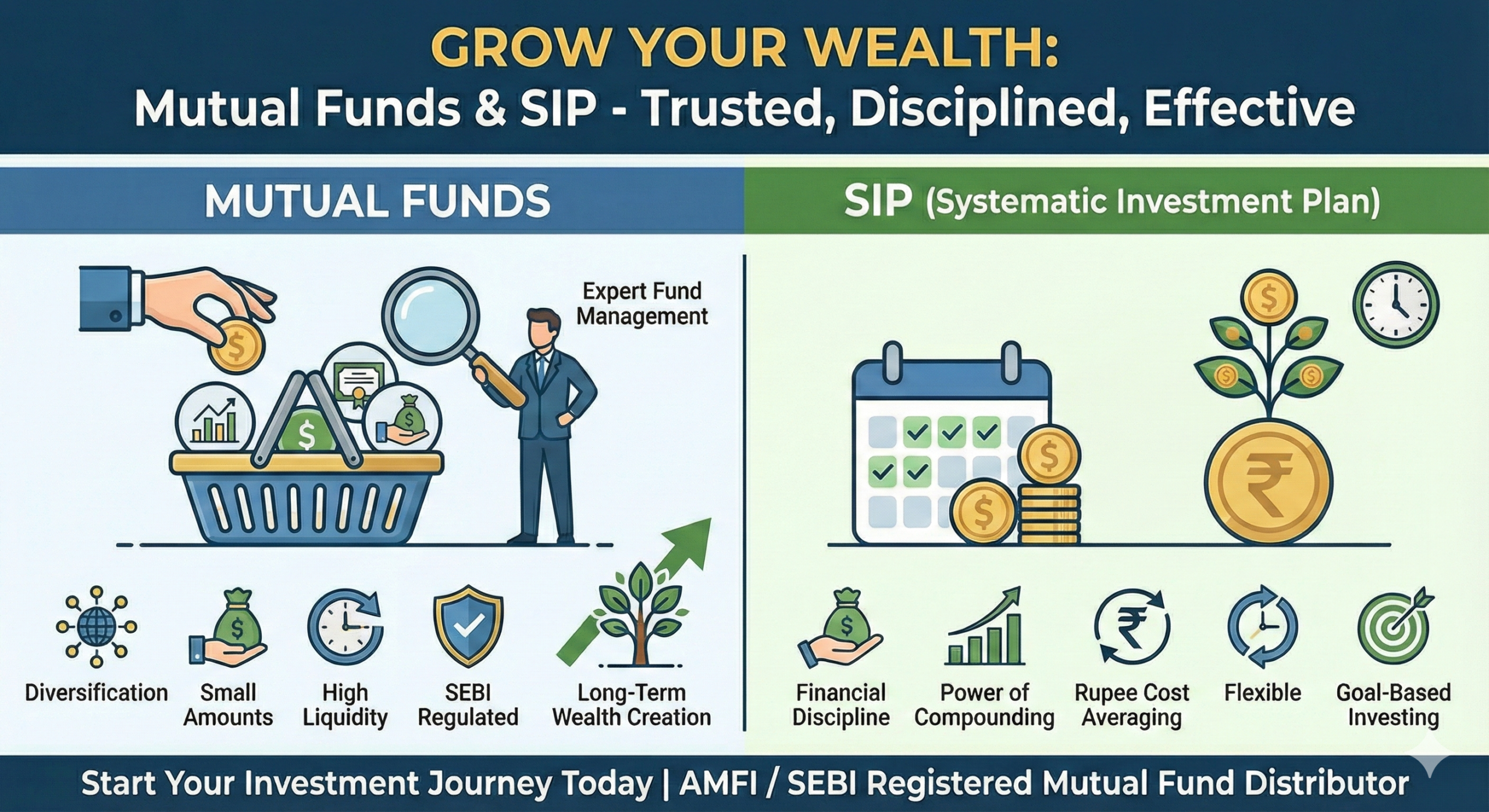

Mutual funds are one of the most trusted and effective ways to grow wealth over the long term. They allow investors to invest in a diversified portfolio of stocks, bonds, or other assets, which are professionally managed by experienced fund managers. This makes mutual funds an ideal investment option for both beginners and experienced investors.

By investing in mutual funds, you can participate in the growth of financial markets without the need for deep market knowledge or constant monitoring.

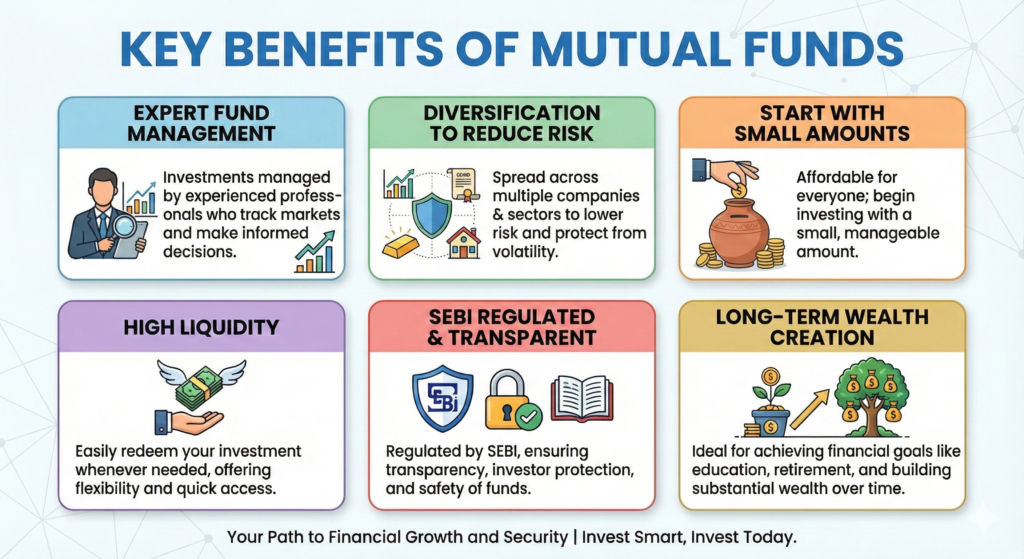

Key Benefits of Mutual Funds

✔ Expert Fund Management

Your investments are managed by professional fund managers who have in-depth market knowledge and experience. They actively track market trends and make informed decisions on your behalf.

✔ Diversification to Reduce Risk

Mutual funds invest across multiple companies, sectors, and asset classes. This diversification helps reduce risk and protects your investment from market volatility.

✔ Start with Small Amounts

Mutual funds are affordable and suitable for everyone. You can start investing with a small amount, making them ideal for first-time investors.

✔ High Liquidity

Most mutual funds allow you to redeem your investment easily whenever you need funds, offering flexibility and liquidity.

✔ SEBI Regulated & Transparent

Mutual funds in India are regulated by SEBI, ensuring transparency, investor protection, and safety of funds.

✔ Long-Term Wealth Creation

Mutual funds are ideal for achieving long-term financial goals such as child education, retirement planning, and wealth creation.

Benefits of SIP (Systematic Investment Plan)

A Systematic Investment Plan (SIP) is a smart and disciplined way to invest regularly in mutual funds. SIP allows you to invest a fixed amount at regular intervals, helping you build wealth gradually over time.

Why SIP is a Smart Choice?

✔ Builds Financial Discipline

SIP encourages regular saving and investing habits, making wealth creation systematic and stress-free.

✔ Power of Compounding

Small investments made consistently can grow significantly over time due to the power of compounding.

✔ Rupee Cost Averaging

SIP helps reduce the impact of market ups and downs by averaging the purchase cost of units over time.

✔ Flexible & Hassle-Free

You can start, stop, increase, or modify your SIP anytime as per your financial situation.

✔ Goal-Based Investing

SIP is perfect for achieving both short-term and long-term financial goals with proper planning.

✔ Suitable for Everyone

SIP is ideal for salaried individuals, self-employed professionals, and first-time investors.

Start Your Investment Journey Today

Mutual funds and SIPs offer a simple, flexible, and effective way to grow your wealth over time. With the right guidance and disciplined investing, you can achieve your financial goals with confidence.

AMFI / SEBI Registered Mutual Fund Distributor

Leave a Reply