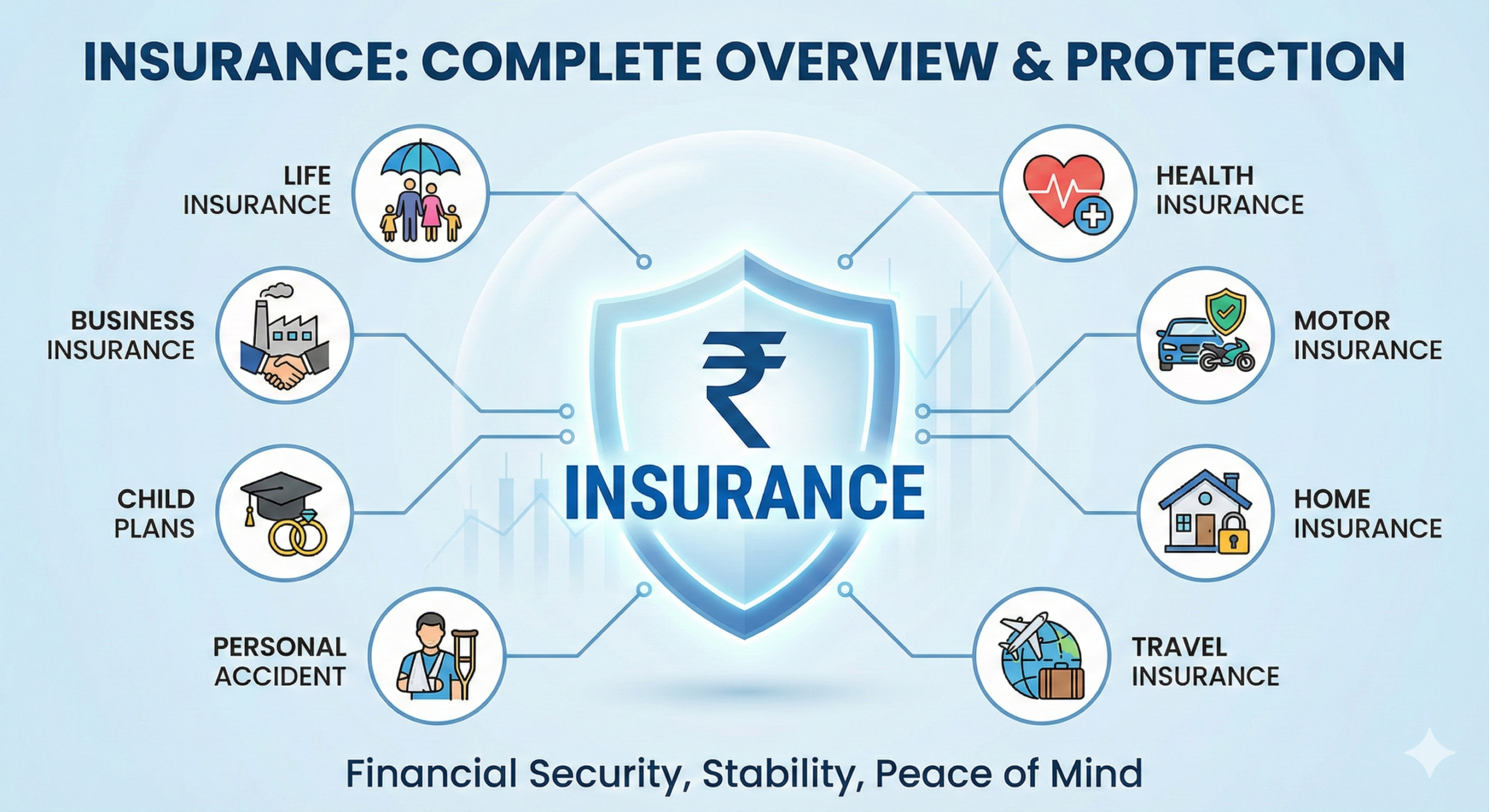

What Is Insurance? – Complete Overview

Insurance is a financial protection tool that helps individuals, families, and businesses manage risks related to life, health, assets, and income. By paying a small amount called a premium, you receive financial support during emergencies or unforeseen events such as accidents, illness, loss, or death.

In simple words, insurance reduces financial stress and provides security, stability, and peace of mind during difficult times.

Types of Insurance

1. Life Insurance

Life insurance provides financial security to your family in case of the policyholder’s death. It ensures that your loved ones can maintain their lifestyle and achieve future goals even in your absence.

Benefits:

- Financial protection for your family

- Long-term savings and wealth creation

- Tax benefits under applicable laws

Types of Life Insurance:

- Term Insurance

- Endowment Plans

- Whole Life Insurance

- ULIPs (Unit Linked Insurance Plans)

- Money Back Plans

2. Health Insurance

Health insurance covers medical expenses such as hospitalization, surgeries, treatments, and critical illnesses, helping you manage rising healthcare costs.

Benefits:

- Covers expensive medical bills

- Cashless treatment at network hospitals

- Tax-saving benefits

Types of Health Insurance:

- Individual Health Insurance

- Family Floater Plans

- Senior Citizen Health Insurance

- Critical Illness Insurance

- Top-up & Super Top-up Plans

3. Motor Insurance

Motor insurance protects your vehicle against accidents, theft, fire, natural calamities, and third-party liabilities. It is mandatory by law in India.

Benefits:

- Legal compliance

- Financial protection against accidents

- Covers repair and third-party liability costs

Types of Motor Insurance:

- Two-Wheeler Insurance

- Car Insurance

- Third-Party Insurance

- Comprehensive Insurance

4. Home Insurance

Home insurance protects your house and household contents from risks such as fire, theft, natural disasters, and other damages.

Benefits:

- Protection for property and belongings

- Coverage for structural and content damage

- Peace of mind for homeowners

5. Travel Insurance

Travel insurance provides financial protection during domestic or international travel and covers unexpected travel-related issues.

Benefits:

- Coverage for medical emergencies abroad

- Trip cancellation or delay protection

- Loss of baggage or passport coverage

6. Personal Accident Insurance

Personal accident insurance offers compensation in case of accidental death or partial or permanent disability.

Benefits:

- Financial support after accidents

- Coverage for disability-related losses

- Affordable premium options

7. Child Insurance Plans

Child insurance plans help secure your child’s future education, marriage, and life goals, even in unforeseen circumstances.

Benefits:

- Education and marriage planning

- Financial security for your child

- Combination of insurance and investment

8. Business & Commercial Insurance

Business insurance is designed to protect businesses from financial losses caused by operational risks and uncertainties.

Types of Business Insurance:

- Fire & Property Insurance

- Marine Insurance

- Liability Insurance

- Employee Health Insurance

Why Is Insurance Important?

- Protects against financial uncertainty

- Encourages disciplined savings

- Provides peace of mind

- Supports long-term financial planning

How to Choose the Right Insurance

Selecting the right insurance plan depends on:

- Your age and income

- Family responsibilities

- Financial goals

- Risk appetite

The right insurance ensures maximum protection without unnecessary costs.

Need Expert Guidance?

At Finance Ki Roshni, we help you choose the right insurance solutions based on your needs, ensuring security, transparency, and trust.

📞 Contact us today for personalized insurance planning.

Leave a Reply